Asos has sold a majority stake in Topshop for £135 million and has announced a £250 million bond refinancing to help to strengthen its balance sheet.

Shares in the online retailer closed up 66½p, or 18.1 per cent, at 434p after the refinancing and the announcement that it had offloaded a 75 per cent stake in the brand to a group controlled by Anders Povlsen, the billionaire who is Asos’s biggest shareholder.

The company said it had entered into a joint venture with a subsidiary of Heartland, part of Bestseller, the Danish fashion business owned by Povlsen, 51. The group owns brands including Vero Moda and Jack & Jones. It had followed a “competitive sales process”, which included interest from the likes of Shein, the fast-fashion specialist, and Authentic Brands Group.

The deal will help Asos to repay debts as it continues to make progress on its “back to fashion” turnaround strategy, which focuses on improving efficiency, reducing stock and strengthening customer relationships.

Analysts at Panmure Liberum, the investment bank, said the bond refinancing and stake sale would “alleviate some of the short-term concerns around the company’s debt position”.

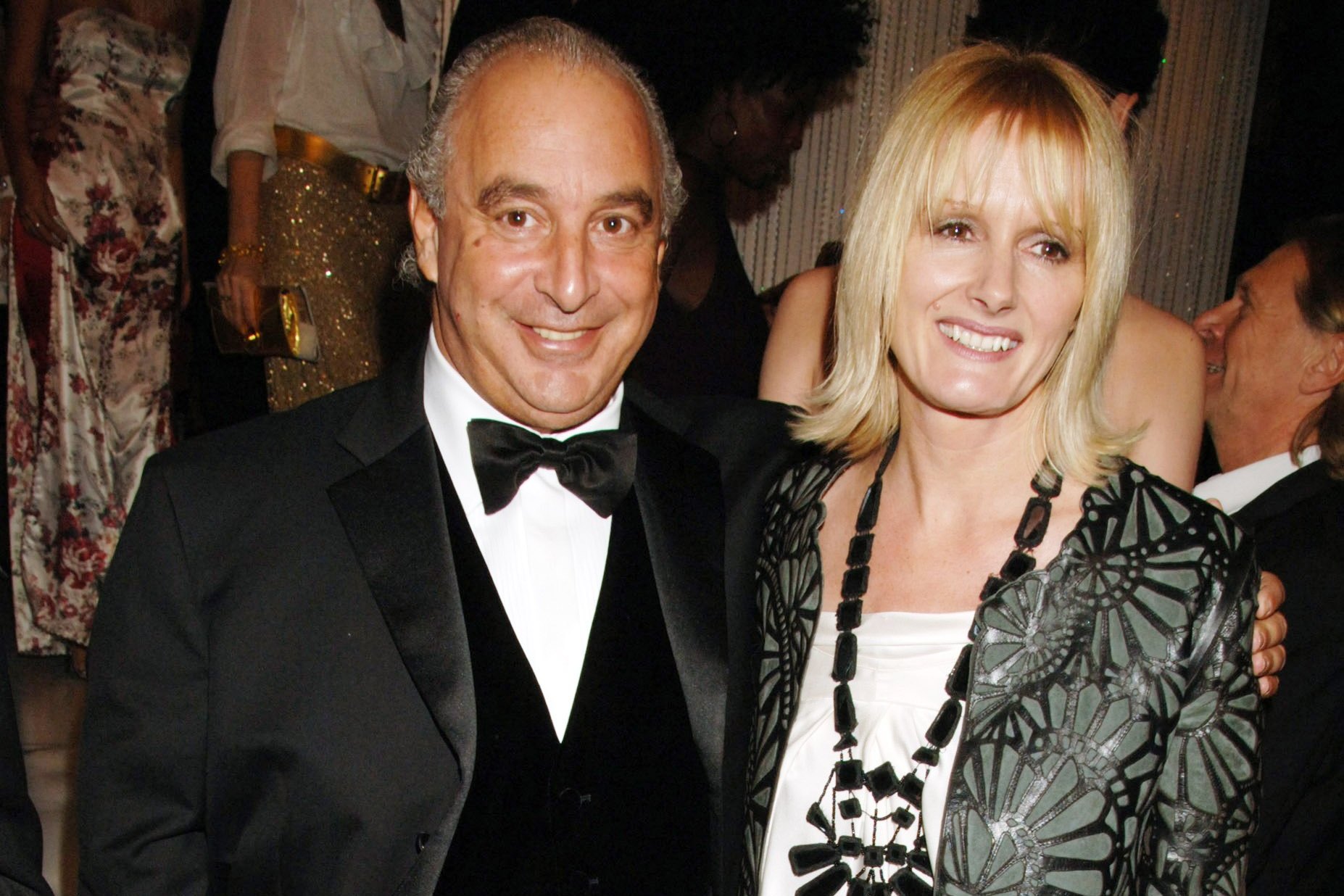

The online retailer purchased the Topshop and Topman brands, the former jewels in the crown of Sir Philip Green’s collapsed Arcadia fashion empire, in 2021 for up to £330 million. It resulted in the closure of about 70 stores, before the brand was relaunched on the Asos website.

Topshop and Topman are among Asos’s best-performing brands. However, Asos had been considering a sale of the labels since last year to help to bolster its balance sheet.

Analysts at Peel Hunt lauded the deal as a “great outcome” for Asos as the deal allowed it to reduce debt while retaining use of the Topshop brand.

Topshop and Topman will continue to be sold on its website, but Asos will pay a royalty fee under a ten-year licence agreement. It said this would result in a profit decline of between £10 million and £20 million this year.